Want to feel in control of your finances?

I use this cash flow forecast tool for my own business and I’ve tested it with dozens of clients. It’s simple to use, you just pop in your numbers, and it works everything out for you. Including the all-important impact of VAT payments on your bank balance. No more surprises – you’re in control of your finances.

Meaning you can quickly move ahead, leaving you more time to work on the things you love

Why this cashflow forecast tool is so useful

You know how important being in control of your finances is. And that being certain about your numbers gives you confidence in all the other areas of your business.

Knowing that your business finances are healthy means you can feel good about moving forward and making other decisions. But most business owners feel a little bamboozled by cash flow because it can feel complicated, and it’s too easy to miss things out. Or it just feels like a hassle to do. The cash flow forecast tool makes checking your cash flow for the next few months easy peasy because it does all the work for you.

What the cashflow forecast tool does for you

Figures out all the calculations immediately

Puts in the VAT calculations automatically

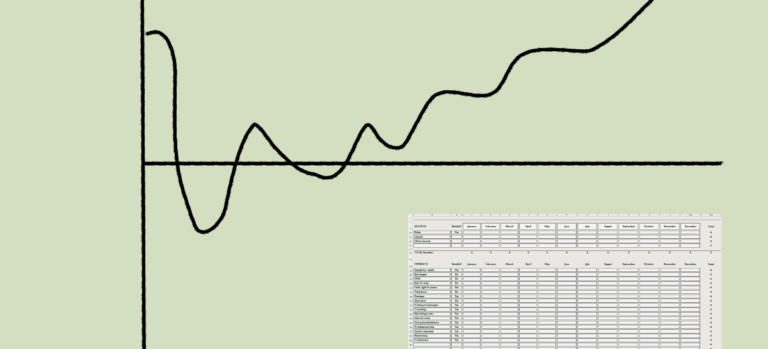

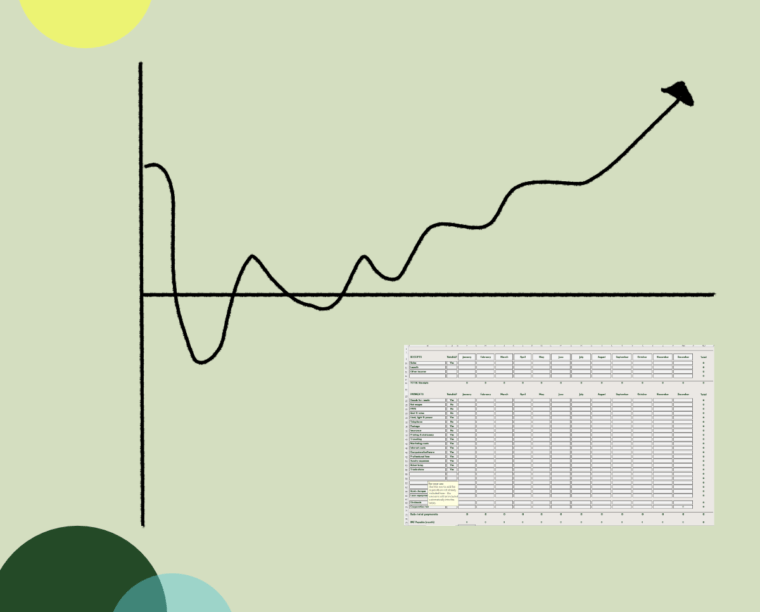

Shows your projected bank balance each month

Highlights any months you need to take action

Who this cash flow planner is useful for VAT registered UK companies

VAT registered UK companies

Business owners who are planning to make changes involving spending money – know for certain that you can afford it

Founders who like to sleep soundly at night

Cashflow forecast tool with automatic VAT calculator

Know for certain what’s going on with your money. Plan out your cash flow, check that your business is going to be financially healthy and make sure that you can afford any new expenditure. And, be sure that you’ve taken the VAT into account in your planning – no surprises next quarter.

Be in control of your finances by spending 10 minutes planning in advance

Simple Excel spreadsheet, just pop your numbers in and it works it all out for you

See how quickly you can see what’s happening with your finances

If you’ve ever found yourself worrying about cash flow or trying to work it out on a piece of paper and thought…I’ve got better things to do with my time. I wish I had a simple, beautiful spreadsheet I could use to work this out for me…here you go.

Enjoy it. It’s a work of art.

Why this cash flow forecast tool works

Quick to use - just pop in your numbers

Automatically calculates your VAT payments for you - no other cash flow forecast tool does this

Give to your bookkeeper to fill out for you - they'll love it and you'll instantly know the health of your company

Excel based cash flow forecasting tool - no need for any subscription and you can do multiple cash flow forecasts if you need to

Cash flow forecast tool - Frequently asked questions

Yes – it’s specifically designed for UK based limited companies that are VAT registered. Just like my own company and many of my clients. I wanted a tool which would automatically take into account the effect of VAT on cash flow, as this is usually the big blip in cash flow for most of us.

I kept getting clients who needed to plan ahead for cash flow, but were finding it difficult. I spent two hours downloading all the free cash flow plan templates, but hardly any of them worked. And none of them seemed to be for VAT registered companies.

After a lot of swearing, I sat down and made my own forecast and then gave it to an Excel expert to improve it, make it look pretty and easy to use and then tested it on my own business. I used it with dozens of clients and finally put it on sale for other companies to use

It’s entirely up to you, of course. But I went through all the free tools and templates out there first, thinking that someone would have made a good one. And they were all a bit rubbish – either they didn’t add up properly, or they didn’t have anything in there for VAT, which is one of the most critical parts of cash flow planning.

I found a couple of good ones, but they were online subscriptions of £35 a month. There is an irony in paying out £35 per month (+ VAT) extra to help you feel secure about your cash flow.

That’s why I made this one—I (and my clients) need a solid tool that works, calculates VAT, and can be used over and over again. I spent a long time making sure it works, plus paying my Excel expert to test it and make it super easy to use.

It’s just £19 inc VAT – I figure it’s quicker for you to buy this and download it than spend hours searching for a free one that works.