How to give away shares in your business

There are many reasons why you might want to give shares in your limited company to someone else. Maybe you need to issue shares to an investor or decide on the equity split for a new business partner. Often, as the MD of a business, you want to reward and incentivise a key member of staff by giving shares to that employee. You want that person to stay around and make even more of a contribution to the business.

How to give shares in your business without it becoming a major headache

When you issue shares to an investor, a business partner or an employee, this is a significant decision, and there are some crucial points to be sure of before you fill out the forms at Companies House to issue the shares.

You need to make sure you understand your options. Giving shares in your business away is usually something we only do once or twice in our lives, and your path can be unclear when you’ve never done this before.

It’s a long-term relationship

When I work with business owners on this, I often point out that giving shares to someone is a bit like getting married because it’s challenging to get out of once you’ve done it. When someone owns a part of your company, it’s more challenging to take this back than getting divorced.

You might think that you can buy them out later, but in reality, this is unlikely. As your company’s value increases, you may find you cannot buy out that employee or investor simply because the value of their shares has gone up over time.

The business will probably never be able to buy them out either because most small businesses don’t have that kind of cash. Don’t confuse your small business with the deals that go on in much bigger companies.

Do you want to share all the money?

If you might want to sell the business in a few years, remember that the person you give shares to will get a slice of the sale price. That could be absolutely fine because their work or investment might have helped you grow the business much more than you could have done on your own, so you all end up with more money. But it’s something to bear in mind, especially if you’re tempted to give them a big chunk of the company early on. I often see start-up founders who are overly generous and then regret this later.

Remember – if you give 20% of the shares in your company to one person, they will get 20% of whatever you get when you sell the company later. And you will only have 80% of the shares left, if you want to give shares to someone else further down the line.

Do you want to pay dividends on the shares you issue?

Most of us business owners use our dividends to pay our mortgage and put food on our table, so you have to be sure that you’re not setting up an automatic right for a shareholder to receive dividends the same way you do as the founder and principal shareholder. Later in this article, there’s some good advice about A and B classes of share and the relationship with dividends.

Giving shares can be a great idea

Giving up shares to an investor

When you give shares to an investor, it’s because they’re giving you cash in return for the shares

This investment is a great way to build up cash flow to invest in marketing, staff or stock. Unlike a bank loan, you don’t have to pay back the money to the investor because they’re getting the shares in return for the investment. They now own a part of your company. An investor is rarely looking for dividends as their return from the company, they want you to give them shares so that they get a proportion of the money when you sell.

Splitting the equity with a business partner

When you’re setting up a new limited company with a business partner, they usually expect to get shares in the new company. But you still want to make sure that you do this in the right way. You want to make sure that you and the company are protected, no matter what might happen in the future. When we start a business with someone we often assume that this should be a 50:50 split between the business partners, but you don’t have to go this way. You should both have different classes of shares to allow you to pay different dividends if you decide to, and you do not have to give the same number of shares to each business partner.

Giving equity to a key employee

Giving shares to a key employee can be a good idea. Especially if that new employee is a valuable person such as a new sales manager or a very experienced technical person, maybe someone you couldn’t afford to pay at their usual market rate. You may be able to entice them away from their dull corporate job by giving them shares in your exciting, fast-growing business.

When you give shares in your company to reward them, it’s a great way to keep people motivated and make them feel that they’re part of the family.

You may already have staff who are vital to the business. You want to incentivise them, make them feel that this is their business too – that they’re more than just an employee. And you want them to stick around and continue working for your company.

Using equity as part of your succession planning

I often speak to business owners who are thinking ahead to their retirement or when they might sell the company. They have people working for them who are ready to step up, maybe to take over as the Managing Director.

Giving senior employees shares in the business can reinforce that you take them seriously and that you’re ready for them to start taking on more responsibility. And, of course, you’re also making it clear that you are willing to share some of the profits with them, which makes it worthwhile for them to take on more of the management role. You may want to start transferring some of the equity to the senior staff who you want to take over sooner rather than later, especially if the business is growing quickly.

But… let’s look at some alternatives here.

Alternatives to just issuing shares

You don’t necessarily have to give shares to other people, especially employees. I often suggest that there are more straightforward arrangements that don’t need as much legal paperwork or such a long term commitment.

Consider a profit-share scheme

You might want to have a profit-sharing scheme for staff, rather than give them shares. That’s a lot simpler to set up. Often, employees would rather have a profit-related bonus where they get some extra cash in their pay packet now than wait for more money in ten years when you may or may not sell the company.

Your new employee might also prefer to work on a part salary, part profit-share basis, rather than getting shares in your company. Think about what would motivate them rather than assuming they would prefer to get shares. You can always ask them which one they would prefer.

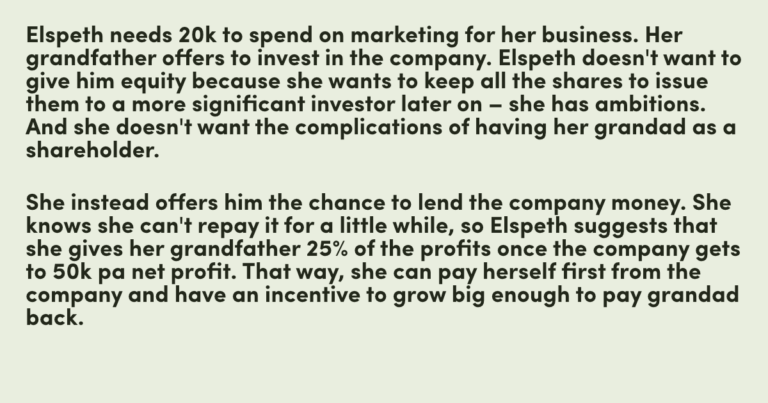

An investor will almost always be looking for equity. Unless they’re a friends and family type investor who are investing primarily because they want to support you. If a family member wants to invest in your company, you may not want to give them shares, because giving shares is forever. You may instead like to suggest that they lend you money and that you pay them back with a share of the profits over a certain level.

What about giving growth shares?

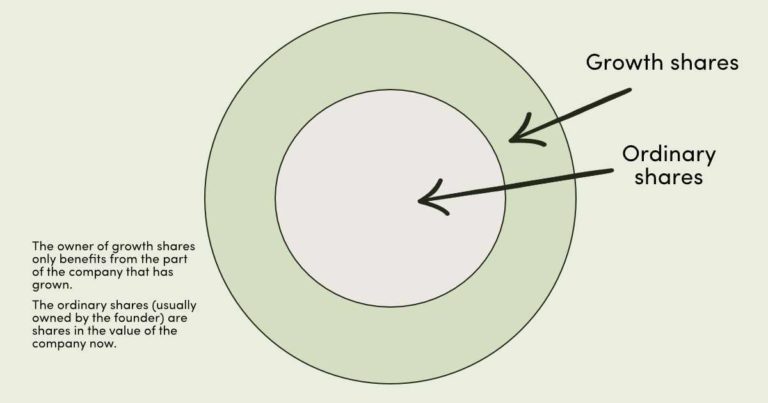

When your company is already well established and making a good profit, you might want to think about using growth shares rather than ordinary shares.

Growth shares are where you give shares to someone, but they only get dividends or a proportion of the sale value on the part of the company that grew after you gave them the shares.

Want to work out your strategy?

How to be sure before you give shares to someone

When you want to give shares to a new employee you want to bring in, there are a few ways you can test things out to be sure.

When I work with clients on this, I often suggest that they employ their lovely new member of staff for a trial six months first. Then you can see how it all works out, and if they’re great, you can issue the shares.

One of my clients did this with a manager she poached from the local company she was setting up in competition with, and they’re now 50:50 business partners in a very successful company.

Ensure you get round to completing the paperwork

You will need a shareholders’ agreement to protect yourself when you give someone shares in your company. The shareholders’ agreement covers what happens to the equity in possible future situations, from a shareholder dying to when a shareholder wants to sell their shares to someone else.

Make sure that you do get around to actually finalising the paperwork to issue the shares. I can’t stress this one enough, as I often see companies where an employee has been promised shares, but somehow they’ve never materialised. Unfulfilled promises can eat away at trust in the senior management team without you knowing about it and should be avoided at all costs.

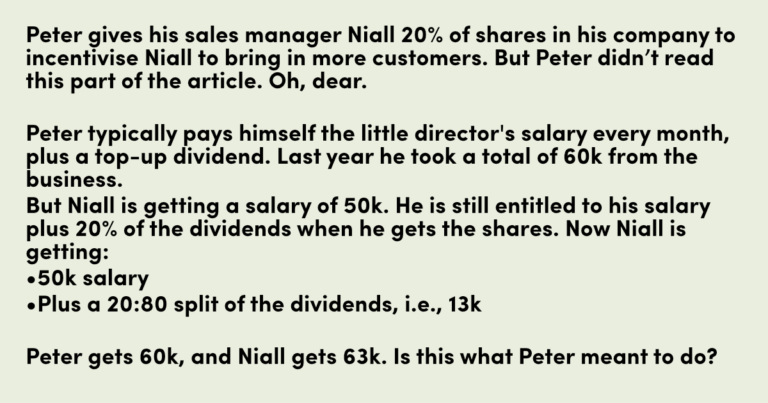

What happens if you issue ordinary shares?

If you issue ordinary shares, the same as you hold, remember that every time you pay yourself a dividend from the company, you will also need to pay a dividend to the other person. And this dividend has to be in proportion to the number of shares each of you owns.

You might not want to pay the dividends in this way, so you need to be clever about how you issue the shares. This brings us to thinking about different classes of shares…

A and B classes of shares

Your investor probably isn’t that bothered about getting a dividend every year. She’s probably more interested in having you give her shares so that she makes a lot of money when you sell the company.

If you give shares to an employee, they probably do want to get a dividend every year. Especially if you give them shares in return for working for you for less than their usual salary. But you still might not want to have to automatically pay a dividend according to how many shares you gave them. Or you have to restrict your dividend pot to avoid paying them more than you want to.

You have the option to give different classes of shares. As the founder, you have A-class shares, and you can give other people B-class shares. The B-class shares don’t have to have voting rights or the automatic right to a dividend, so this way protects you.

This is also pretty common when you’re gifting shares to your wife, husband or another family member, by the way.

Get a shareholders agreement when you give shares

![]()

Get a shareholders’ agreement when you issue shares to someone. I can’t emphasise this enough and have been known to jump up and down and stamp my feet with clients who don’t think this is necessary.

A shareholders’ agreement will clarify how it all works and what the expectations are on both sides. It will protect both of you.

If you find yourself putting off sorting out the paperwork, then outsource this. Your accountant will fill out the forms for ordinary shares (including the A and B class shares I talk about a little further on). And a lawyer will sort out all the details of the shareholders’ agreement. If you decide to go down the less expensive option of downloading a template from the Internet but then find that you don’t fill out all the forms, I recommend just paying for a lawyer to do it for you.

How to legally issue the shares

Check that your memorandum and articles allow you to issue the shares and how many shares you have already. If you only have one share, you might have to issue more to give shares to someone else; you can’t give a percentage of a share

Fill out form SH01 with Companies House when you issue shares, as that form makes it legally binding. You don’t need a share certificate or anything 18th century – it’s what’s on record at Companies House that counts.

For all the boring stuff, Gov.UK has a good guide. My advice is to get your accountant to do all the boring stuff for you. They love filling out forms and should do it properly. They can also go through the tax implications for you.

Tax implications when you issue shares in your business

Giving shares to someone may have tax implications depending on whether the shares you issue are worth anything. If you’re a new start-up or don’t have many sales yet, the company only has any value to you, so there are no real tax implications.

Please don’t quote me on this; it’s up to you to check out your situation.

If you’re further down the road and the business is making more profit, the shares could be worth money. And that is where HMRC starts to get interested. They might want to know if you’ve transferred an asset below the market rate.

HMRC’s thinking goes like this:

You don’t want to lumber your employee with a fat tax bill when you give them shares so it’s best to be clear beforehand. An experienced accountant is worth their sausages.

Summing up

Photo credits to gorilla from pxhere, thumbs up IA Walsh, Sharon McCutcheon and rawpixel on Unsplash, Simon Dack from Vervate

Diagrams, drawings and text by Julia Chanteray